Job Description

Divar’s business is growing rapidly and so the number of entities we have financial relationships with (such as partners, suppliers, contractors, banks, creditors, etc.)

One recipe to maintain this rapid growth is to make our payments as fast and as organized as possible. Failing to pay the suppliers or other entities in a timely manner may hurt the business and render the payment process to a business bottleneck.

The need for keeping the payments organized aside, we also need to manage the structure of the cash and cash equivalents to prevent the loss of financial return on assets (by keeping the money in low-interest rate bank accounts, for example) as well.

Your role in this team is to handle the daily treasury operations of Divar and help us maintain our business growth and keep all the beneficiaries satisfied. This role reports to the accounting manager who is responsible for group funding, investment, cash flow, all treasury operations, currency risk management, and liquidity policy, procedures, and processes.

Responsibilities:

1. Executing daily cash operations such as cash payments, drawing cheques, collecting cash from the company's sales operations, etc.

2. Opening or closing bank accounts per the company’s need.

3. Executing foreign money transfers and following them up.

4. Recording treasury operations in the ledger books and keep the books in sync with real balances.

5. Reconciling banks, safe, and other cash and cash equivalent resources with the ledger books.

6. Watching the bank account balances to maintain enough balance for the near payments.

7. Keeping track of foreign debit/credit card balances and charge them as needed.

8. Reporting the payment process issues to the treasury manager.

9. Executing the company's KYC policies for payments and recipients.

10. Cooperating with external auditors in its due time.

11. Safeguarding and securing valuable documents and notes.

12. Safeguarding and securing the company's internet accessible bank or other panels.

13. Maintaining the cardex of local and foreign notes.

14. Maintaining a working relationship with banks and exchange offices.

Requirements

- Having a good grasp of money and bank operations. - Having more than two years of experience in clerical work or one year in the treasury field. - Being self-organized and capable of organizing routine activities. - Being able to handle work in stressful situations. - Having good communication skills and the ability to keep good manners when dealing with customers in all situations. - Having a Bachelor's degree in Accounting is a plus. - Experience in foreign money transfers and or English knowledge is a plus.

Employment Type

- Full Time

Job Category

Educations

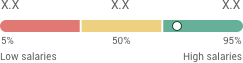

Seniority

Details

Employment type

- Full Time

Job Category

Educations

Seniority

To see more jobs that fit your career

Similar Jobs